We argue that when making investments in innovation, leaders cannot pick the winning ideas on day one. Instead, we have to allow the winning ideas and teams to emerge by creating the right context. While investing resources in innovation is important, it is also about how we use those investments to manage uncertainty and reduce risk in new ideas. Companies need to take a portfolio approach that involves making many small bets, tracking progress via key metrics and increasing investments only in those ideas that show evidence of traction.

Exploit - Explore

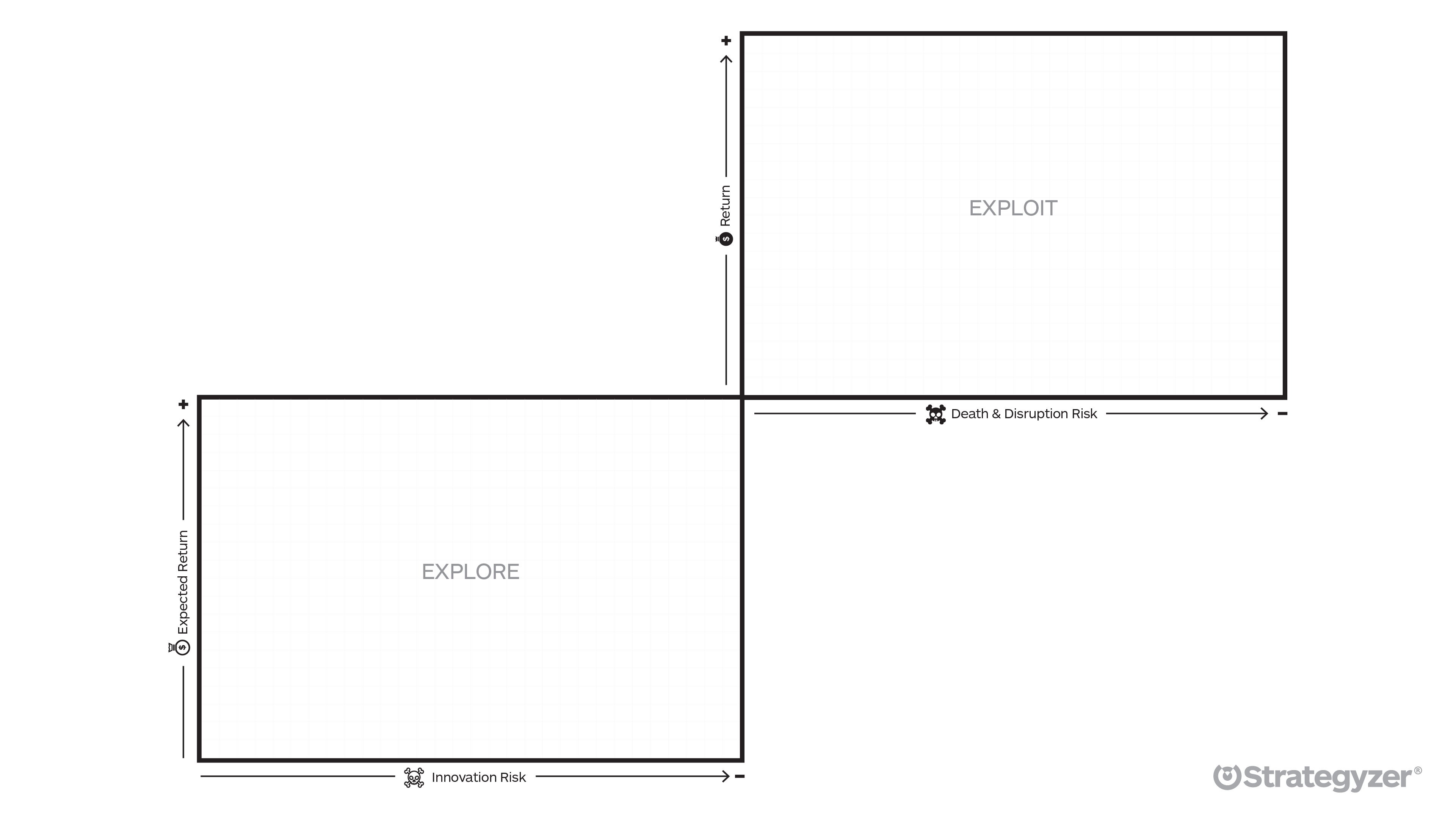

In today’s business environment, companies have to constantly reinvent themselves. The best way to do that is to be good at doing two things at the same time; exploiting and improving current business models while exploring for new ones. Leaders cannot invent the future without managing the present. As such, they have to think of their business as two distinct but connected portfolios.

The Exploit portfolio is focused on managing and improving existing businesses. There is limited uncertainty in this portfolio because we are mostly serving known customers using known business models. In contrast, the Explore portfolio is about inventing new value propositions and business models. There is more uncertainty and a greater chance of failure because teams have to discover customer needs as well as the right business model to deliver their value proposition.

Teams working on an idea within the Explore portfolio cannot figure out the right business model on day one. Instead, they have to allow the right business model to emerge through testing and iteration. For example, it took over four years and three business model iterations before the success of Amazon Marketplace. Amazon CEO Jeff Bezos is one of the few corporate leaders that understands the importance of embracing uncertainty and failure in order to succeed with innovation. Bezos describes Amazon as the best place to fail!

Portfolio Management

Given the differing levels of uncertainty, the investment philosophy for Exploration versus Exploitation has to be different. Exploitation is about dividends and returns from managing existing businesses. In contrast, Exploration has to be managed using a venture capital model. Since we can’t pick the winners without investing in failure, we have to treat Exploration as a portfolio of multiple bets on new value propositions and business models. The expectation is that most of our bets will fail and that the few that succeed will provide great returns. This is how world-class venture capital funds operate.

A good example is Fred Wilson, co-founder of the New York city-based venture capital firm Union Square Ventures notes that their target batting average is ⅓ - ⅓ - ⅓. They expect to lose all their money on ⅓ of their investments, get their money back or a small return on ⅓ of their investments, and generate the bulk of their returns on ⅓ of their investments. Industry Ventures present data from several venture capital funds that shows that up to 65% of their early-stage investments lose money and only 10% of their early-stage investments provide returns above five times the initial investment. Large companies investing in innovation have to adopt a similar mindset, make multiple bets and start winning by losing.

It is important to note that making investments in the Explore portfolio is not about passively throwing money against the wall and seeing what sticks. The goal of every investment we make is to actively manage uncertainty and reduce risk. As such, teams working on new ideas are expected to use the investment they get to test whether there is a real market opportunity and a profitable business model. In other words, we are not just investing in ideas or technologies, we are investing in teams to gather evidence of the desirability, feasibility and viability of their business model.

Instead of running our venture fund as a series of one-off large investments, we have to use metered funding. In this practice, we begin by making small investments in many teams that then work in consecutive sprints to test their ideas. Our role as leaders is to track progress and see which teams are doing well. Not all the teams we invest in will succeed. Instead, we will make follow-on investments on the small fraction of teams that show evidence of traction in the market (i.e. desirability, feasibility and viability). Our approach is evidence based investment decision making with an emphasis on teams reducing the risk and uncertainty within their ideas. This is the approach that was taken by Bayer’s Catalyst Fund.

Bayer’s Catalyst Fund

At Bayer the goal is to drive innovation across the whole value chain, especially in those areas that are traditionally focused on exploitation. Bayer’s Corporate Innovation Team consists of Henning Trill – Head of Corporate Innovation, Julia Hitzbleck – Head of Life Hub Berlin, Ouelid Ouyeder – Senior Program Lead for Entrepreneurship and Peng Zhong – Senior Program Lead for Entrepreneurship

Their Catalyst Fund is run like a venture fund. Over the past two rounds they have received over 250 proposals from which they have invested in 52 projects. The initial investment into each project team is €50,000 and the teams are expected to generate evidence that the opportunity is real and that the solution they have in mind that is desired by the potential users or customers.

After four months the teams convened to present their evidence to senior business leaders. These senior leaders were trained to make decisions based on evidence not how much they liked the idea. 51 projects from the initial 52 investments made it to the pitch day. Of these, 21 projects were selected for a second round of funding. The average funding that was granted at this next stage was €150,000. Of the projects that got further funding, only 11 have successfully shown feasibility and viability in a pilot and have been taken to scale within the business. Of the 30 projects that did not make it into the second round of funding, 8 got implemented as part of other projects.

This pattern of data from Bayer, maps well onto the innovation management model we have been describing in this article. Approximately 60% of the projects from the initial round of funding failed to move on to the next round. Of the projects that moved to the next round, approximately half got further funding, have been scaled and are providing good returns. This represents just over 20% of the initial cohort of projects. Another 15% of the initial projects have been implemented as part of other projects, providing moderate returns.

Conclusion

Traditionally, corporate leaders have viewed their role as being able to pick the winning ideas and make investment decisions. This practice might have some success within the Exploit portfolio. However, the Explore portfolio has too much uncertainty and risk for leaders to be able to pick the winning ideas upfront. Given the numbers of unknowns, the role of leadership should be to create the right conditions for the winning ideas to emerge.

This means that they have to invest in the Explore portfolio by making several bets and allowing teams to test value propositions and business models; and bring evidence before further investment decisions are made. With such an approach to innovation management two things happen:

- The best ideas will emerge through an evolutionary process of testing and gathering evidence.

- The best teams with the right capabilities to take the product to market will also emerge.

The clear take away for leaders is that they are no longer responsible for picking the winners. Instead, they can create the context in which the winning ideas emerge so we can better allocate resources. This requires a cultural change that recognizes the difference between Exploit versus Explore, makes multiple bets in the Explore portfolio, tracks progress using the right metrics and invests more resources in ideas based on evidence.

Learn everything there is to know about managing innovation pipelines with Alexander Osterwalder's latest book:

The Invincible Company